The trend-following strategy is a popular trading method that capitalizes on market momentum. It involves identifying and riding the direction of market trends until they show signs of reversal.

Here’s a breakdown of how it works and why traders rely on it:

Key Principles of Trend-Following:

- Identifying Trends:

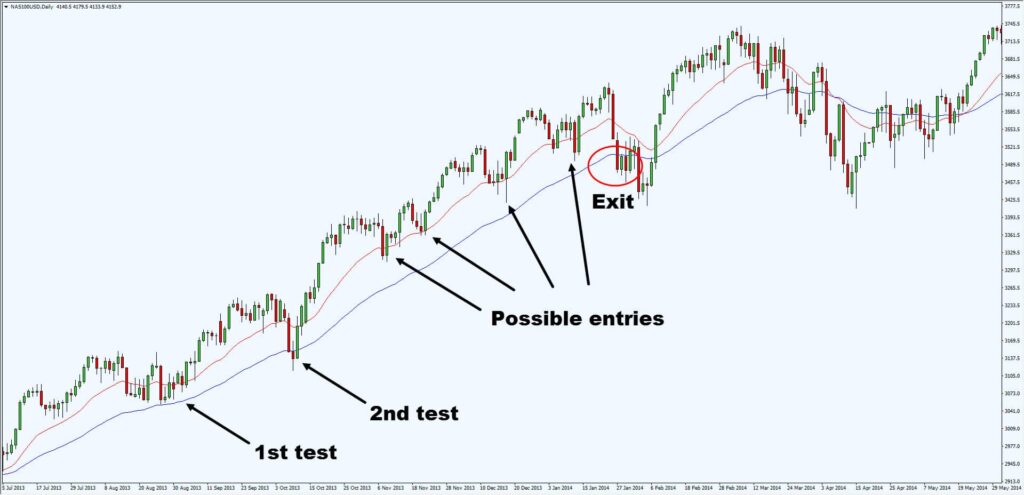

- Traders use technical indicators like moving averages, MACD, ADX, and trendlines to spot market trends.

- An uptrend is characterized by higher highs and higher lows, while a downtrend features lower highs and lower lows.

- Entering the Market:

- Traders enter long positions when indicators confirm an uptrend and short positions during a downtrend.

- A common entry signal is when the price crosses above a moving average for a buy or below it for a sell.

- Risk Management:

- Stop-loss orders are placed to limit potential losses in case of trend reversal.

- Trailing stops are used to lock in profits by adjusting as the trend progresses.

- Exiting Positions:

- Positions are closed when indicators show trend weakening or reversal.

- For example, a crossover below a moving average might signal an exit.

Advantages of the Strategy:

- Simplicity: Easy to understand and implement.

- Effectiveness in Trending Markets: Works well when there is a clear market direction.

- Long-Term Gains: Profits can be substantial when riding sustained trends.

Drawbacks to Consider:

- Sideways Markets: Trend-following can result in false signals during range-bound or choppy markets.

- Signal Delays: Entering and exiting can lag as traders wait for trend confirmation.

Practical Use:

Trend-following can be applied to various timeframes and asset classes, including stocks, forex, and cryptocurrencies. This strategy demands patience and discipline but can offer consistent returns when used effectively.

Conclusion: The trend-following strategy remains a trusted approach for traders looking to capitalize on extended market movements. While it may require careful risk management and adaptability, its simplicity and potential for profit make it a favored choice among traders.