Articles

What Is a Liquidity Sweep? How Stop Hunts Move the Market

A liquidity sweep occurs when price moves beyond obvious support or resistance to trigger clustered stop-loss orders before reversing. Understanding how stop hunts work helps traders interpret failed breakouts and sudden spikes in both stock and crypto markets.

What Is a Bull Trap? Why Breakouts Sometimes Fail

A bull trap occurs when price breaks above resistance, attracts breakout buyers — and then quickly reverses lower. These false moves often trigger emotional entries before momentum fades. Understanding bull traps helps traders avoid chasing weak breakouts and manage risk more effectively in both stock and crypto markets.

What Is Volume Profile? How Trading Activity Reveals Key Price Levels

Volume Profile reveals where real trading activity concentrates across price levels — showing which prices the market accepts or rejects. By mapping volume instead of time, it helps traders identify key support, resistance, and value zones in both stocks and crypto markets.

What Is Market Structure? Higher Highs and Lower Lows Explained

Market structure explains how price trends form through higher highs, higher lows, lower highs, and lower lows. Understanding structure helps investors identify trend direction and changing market conditions in stocks and crypto.

What Is Order Flow? How Buying and Selling Pressure Moves Markets

Order flow shows how buying and selling pressure drives price movement in real time. By understanding how orders interact with liquidity, investors can better interpret market direction in both stocks and crypto.

What Is VWAP? Why Institutions Track This Price Level

VWAP is a volume-weighted price benchmark used by institutions to measure execution quality and intraday fair value. Understanding VWAP helps traders interpret price behavior and avoid chasing inefficient entries in both stocks and crypto markets.

What Is Volume Profile? How Trading Activity Reveals Key Price Levels

Volume Profile reveals where trading activity is concentrated across price levels. By showing where markets accept or reject value, it helps investors identify key support, resistance, and decision zones in both stocks and crypto.

What Is Price Discovery? How Markets Find Fair Value

Price discovery is the process through which markets determine fair value as new information, liquidity, and expectations interact. Understanding price discovery helps investors make sense of price movements in both stocks and crypto markets.

What Is Slippage in Trading? Why Orders Fill Worse Than Expected

Slippage explains why trades sometimes execute at worse prices than expected. Caused by limited liquidity and fast-moving markets, slippage plays a key role in execution risk for both stock and crypto traders.

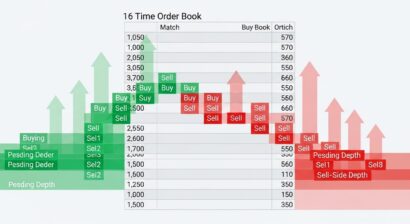

What Is Market Depth? Why Order Books Matter in Stocks and Crypto

Market depth shows how much buying and selling a market can absorb without major price movement. By understanding order books, investors can better interpret volatility, execution risk, and price behavior in both stocks and crypto.

What Is Market Liquidity Risk? Why Markets Freeze During Stress

Market liquidity risk explains why trading can suddenly slow or freeze during periods of stress. When buyers and sellers step back at the same time, prices can move sharply, even without major fundamental changes.

What Is Market Sentiment? How Fear and Greed Move Stocks and Crypto

Market sentiment reflects how fear and greed influence investor behavior. Understanding sentiment helps explain rapid price moves in stocks and crypto and allows investors to navigate volatility with greater discipline.